The 17 6 Year Stock Market Cycle Connecting The Panics Of 1929 1987 2000 And 2007 Pdf

Use features like bookmarks note taking and highlighting while reading the 176 year stock market cycle.

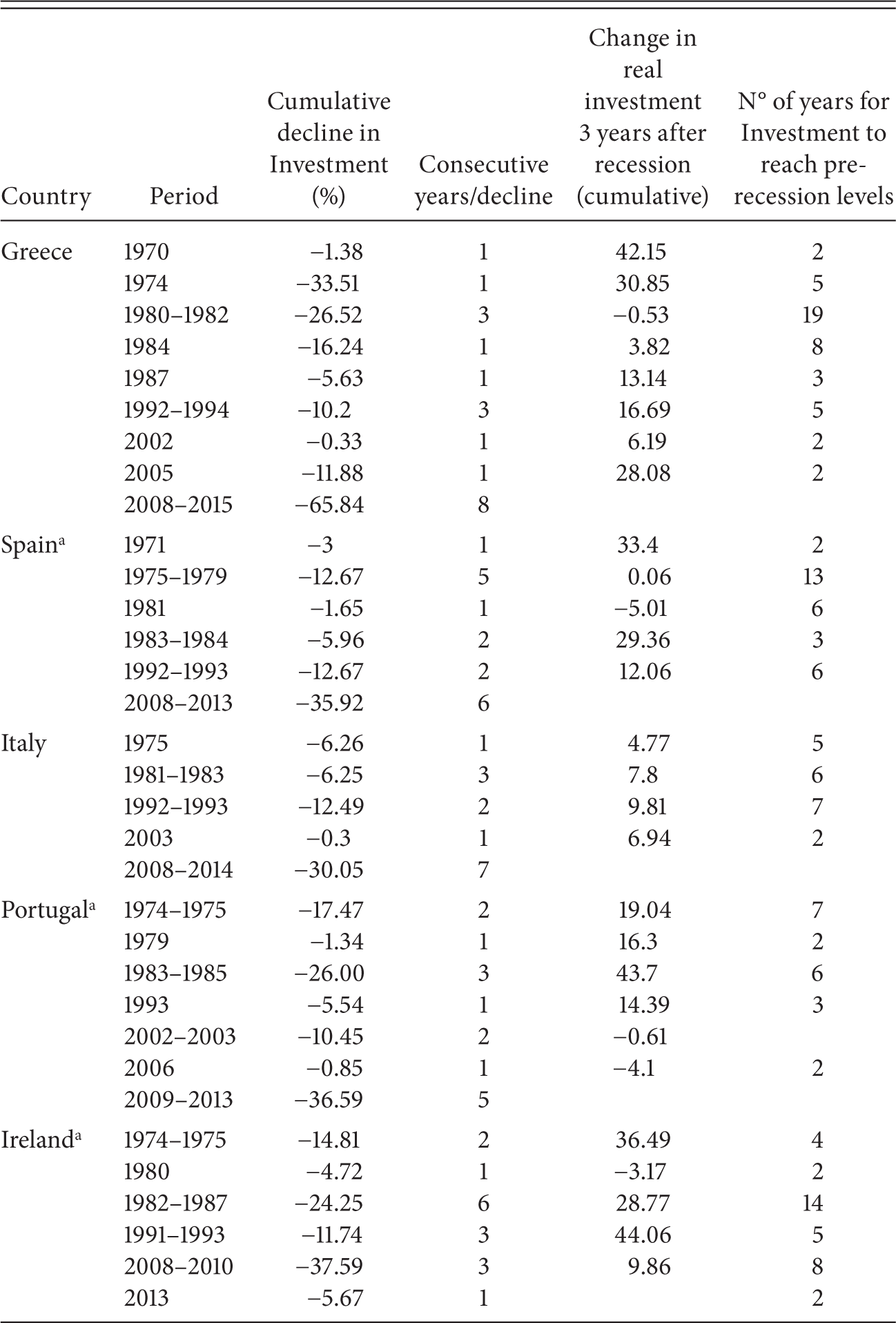

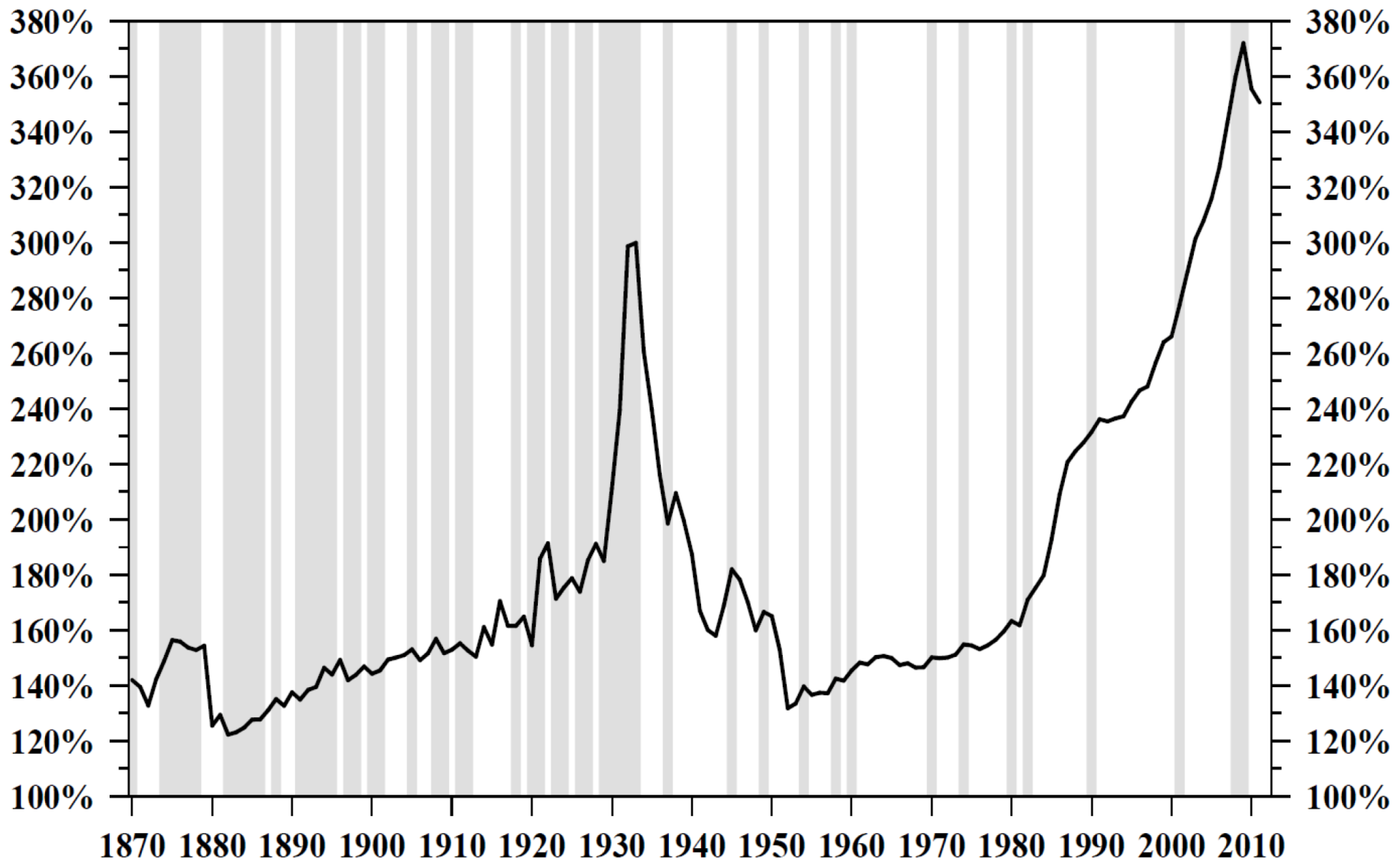

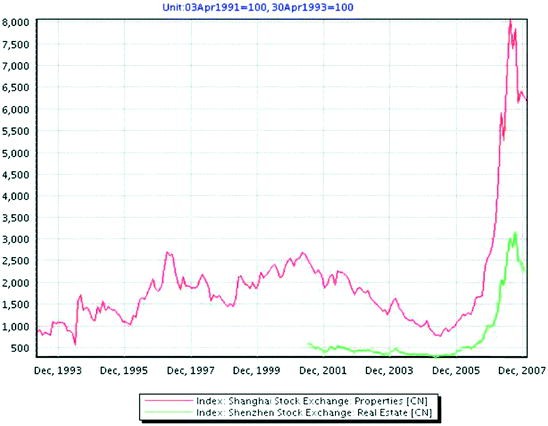

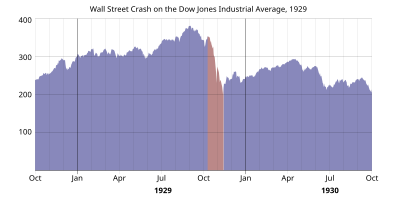

The 17 6 year stock market cycle connecting the panics of 1929 1987 2000 and 2007 pdf. But stock markets are cyclical too. The 176 year stock market cycle. Free shipping on qualifying offers. 9780857192738 kostenloser versand fuer alle buecher mit versand und verkauf duch amazon.

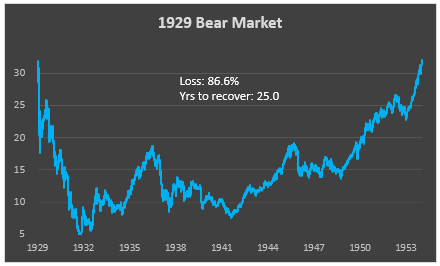

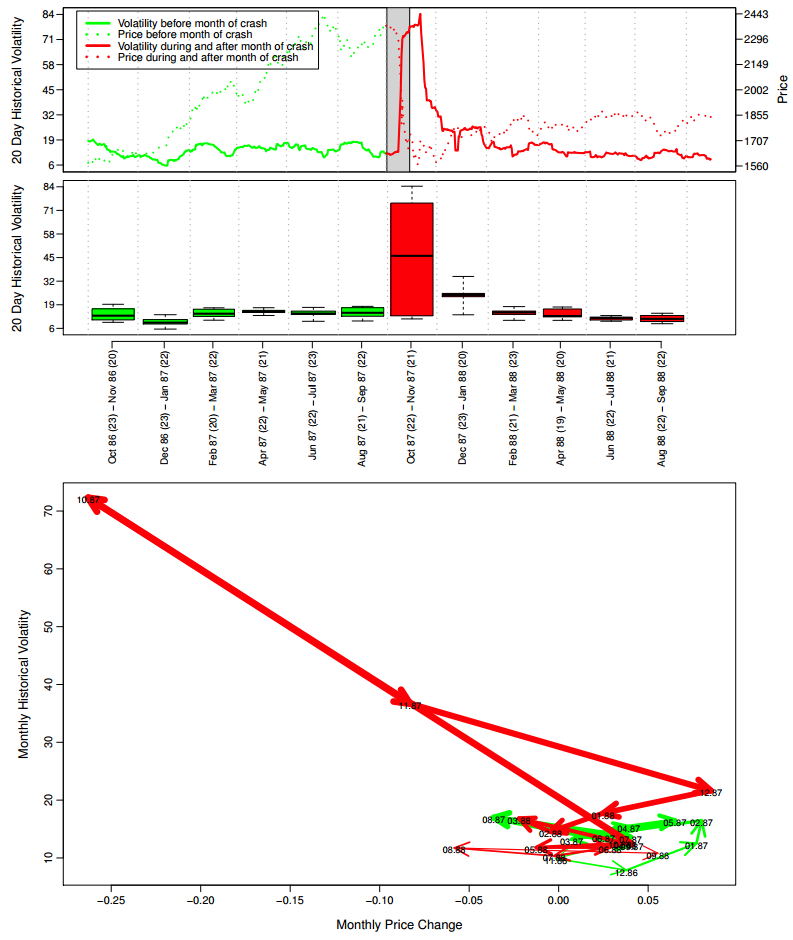

The 176 year stock market cycle. Connecting the panics of 1929 1987 2000 and 2007 published by harriman house. Connecting the panics of 1929 1987 2000 and 2007. Get this from a library.

The 176 year stock market cycle. The 176 year stock market cycle is a relatively slight book because it contains so few wasted words. Connecting the panics of 1929 1987 2000 and 2007. Connecting the panics of 1929 1987 2000 and 2007.

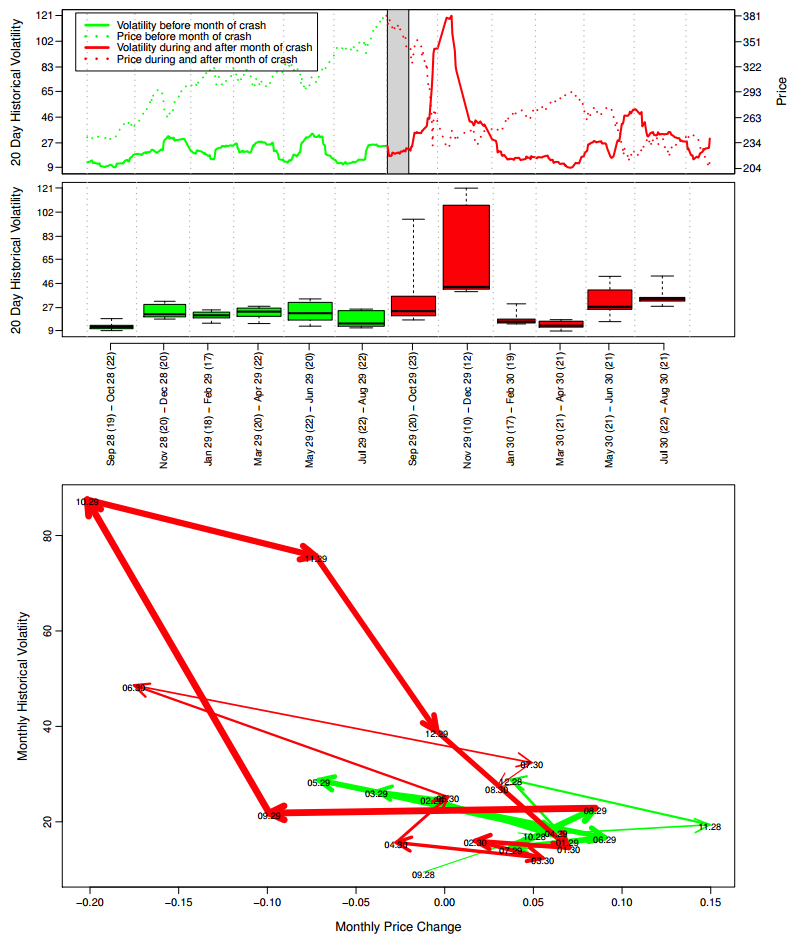

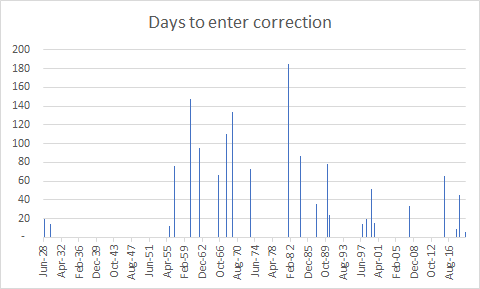

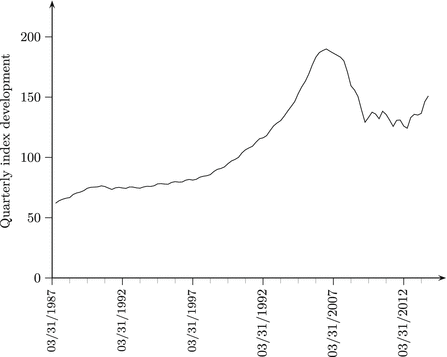

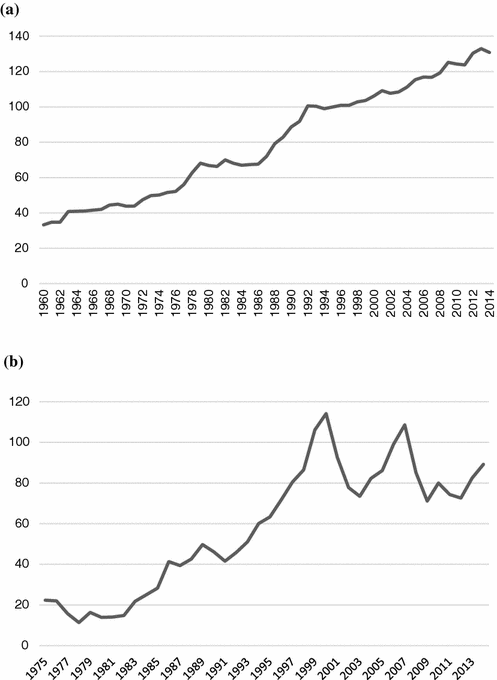

I have called this cycle the balenthiran cycle and that is the subject of my book the 176 year stock market cycle. Without 2 free months. 176 year stock market cycle. Get this from a library.

Connecting the panics of 1929 1987 2000 and 2007. Download it once and read it on your kindle device pc phones or tablets. The 176 year stock market cycle. Kerry balenthiran how do we know where we are in the current stock market cycle are we in the midst of a new long term bull market or a market rally within an ongoing bear marketthe answers to the above questions.

Kent balenthirans the 176 year stock market cycle. Connecting the panics of 1929 1987 2000 and 2007. I enjoyed the brief tours of cycle theory and stock market history and take some comfort from the conclusions kerry balenthiran draws. That is more than enough time to analyse the validity of my long term cycle and determine whether the forecast was accurate.

Kerry balenthiran how do we know where we are in the current stock market cycle. Twitter reddit linkedin facebook. Connecting the panics of 1929 1987 2000 and 2007 kindle edition by balenthiran kerry. Are we in the midst of a new long term bull market or a market rally within an ongoing bear market.

Long term followers will know that i used the medium term cycle 176 weeks to forecast a top on 25 may 2017. Jul 2 2019 written by andree huk. Connecting the panics of 1929 1987 2000 and 2007 balenthiran kerry isbn. Connecting the panics of 1929 1987 2000 and 2007 harriman house 2013 is a difficult book to reviewthe problem is that in this 91 page.

The 176 year stock market cycle. Connecting the panics of 1929 1987 2000 and 2007. The 176 year stock market cycle.

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)